Overview

What is Airbase?

Airbase headquartered in San Francisco offers a cloud-based accounts payable and spend management solution, and combines a pre-approval system with corporate cards, allowing users to manage the entire AP spend process in one place.

Theoretically a good system if issues with entities could be resolved.

Love for Airbase

User Review

Airbase solves multiple AP pain points in one easy to use platform.

Easy to use expense system!

Airbase has been a breeze!

Airbase is simple and easy to use

Expense reimbursement reviews and approvals have been smoother thanks to Airbase

Airbase has easy to use UI and is a quick to process expense tool for the win!

Easy interface to request a card with Airbase

Utilizing Airbase's virtual credit cards has significantly transformed our approach

Airbase is a great tool - I'd buy it again

Airbase = Easy

Airbase helps you to better manage your business.

Popular Features

- Customizable Approval Policies (17)9.090%

- Payment Status Tracking (17)8.787%

- Payment Audit Trail (16)8.686%

- Financial Document Management (16)8.181%

Reviewer Pros & Cons

Pricing

What is Airbase?

Airbase headquartered in San Francisco offers a cloud-based accounts payable and spend management solution, and combines a pre-approval system with corporate cards, allowing users to manage the entire AP spend process in one place.

Entry-level set up fee?

- No setup fee

Offerings

- Free Trial

- Free/Freemium Version

- Premium Consulting/Integration Services

Would you like us to let the vendor know that you want pricing?

28 people also want pricing

Alternatives Pricing

What is BILL?

BILL is an online service for SMBs which provides a central dashboard for managing Accounts Receivable, Accounts Payable, and cash flow management. It syncs with all major accounting systems like QuickBooks, Sage, Intaact, and NetSuite.

What is Webexpenses?

Webexpenses is a global provider of online expense management software to businesses of all sizes across 70+ countries. The software is used across all industries, including retail, finance, technology, construction, and not for profit. Features of the Webexpenses desktop and mobile app include…

Features

Payment Management

Features that allow for the management of payments across various forms of finance/accounting software.

- 9Customizable Approval Policies(17) Ratings

Policies for different types of approvals can be customized, sent to multiple approvers, automatically approved, etc.

- 8.1Financial Document Management(16) Ratings

Invoices, expense reports, and associated documents are stored within the platform for any future needs.

- 8.7Payment Status Tracking(17) Ratings

Tracks what stage payments are at in the process, from approval to receipt.

- 8.6Payment Audit Trail(16) Ratings

Allows admin users visibility into the entire payment process, from receiving the expense claim or invoice to the payee receiving payment.

- 8.3Duplicate Bill Detection(15) Ratings

Detects duplicate invoices or expense reports to prevent double payments.

- 7.5Advanced OCR(14) Ratings

Automatically imports information from invoices, receipts, expense reports, and other scanned documents into the platform.

- 8.2Electronic Funds Transfer(14) Ratings

Funds can be transferred via EFT as opposed to paper checks.

Accounts Payable

Features found in accounts payable software products

- 8.5Automated Accounts Payable Processes(16) Ratings

Accounts payable processes are automated based on pre-determined workflows.

- 8.5Vendor Management(15) Ratings

Holds information related to vendor terms and contracts.

Product Details

- About

- Integrations

- Competitors

- Tech Details

- FAQs

What is Airbase?

Airbase is a procure-to-pay solution that blends enterprise capabilities with a simplified user experience.

Key Benefits.

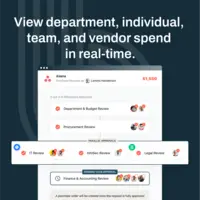

With Airbase, mid-market to early-enterprise level companies streamline complex approval and accounting processes for all non-payroll spend while ensuring employee adoption across the entire organization.

Workflow management.

Navigable complex approval and accounting workflows with configurable, no-code workflows.

Time and cost savings.

Eliminates unnecessary spending, saving time and resources, and reducing the time to close.

Comprehensive product suite.

Any or all products can be integrated—Guided Procurement, AP Automation, Expense Management, and Corporate Cards—to meet current demands and future scalability.

Compliance and collaboration.

Integrations with adjacent business systems directly or via an open API mean all stakeholders can work with their existing tools.

Airbase Features

Accounts Payable Features

- Supported: Automated Accounts Payable Processes

- Supported: Vendor Management

Payment Management Features

- Supported: Customizable Approval Policies

- Supported: Financial Document Management

- Supported: Payment Status Tracking

- Supported: Payment Audit Trail

- Supported: Duplicate Bill Detection

- Supported: Advanced OCR

- Supported: Electronic Funds Transfer

- Supported: PCI Compliant Security Measures

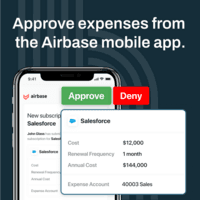

Airbase Screenshots

Airbase Integrations

Airbase Technical Details

| Deployment Types | Software as a Service (SaaS), Cloud, or Web-Based |

|---|---|

| Operating Systems | Unspecified |

| Mobile Application | Apple iOS, Android |

| Supported Countries | United States |

| Supported Languages | English |

Frequently Asked Questions

Comparisons

Compare with

Reviews and Ratings

(49)Attribute Ratings

- 8Likelihood to Renew1 rating

- 7Availability1 rating

- 8Performance1 rating

- 8.1Usability8 ratings

- 8Support Rating2 ratings

- 9Online Training1 rating

- 8Implementation Rating1 rating

- 8Product Scalability1 rating

- 7Ease of integration1 rating

- 8Vendor pre-sale1 rating

- 8Vendor post-sale1 rating

- 1Professional Services1 rating

- 8Contract Terms and Pricing Model1 rating

Reviews

(1-5 of 5)Airbase for Large Multi-entity users

- GL Integration

- Vendor Management, including 1099s

- Virtual Cards

- The prefund requirement for corporate cards is burdensome for a multi-entity company.

- Many of the pages require you to view one entity at a time, which is inefficient when managing many different entities on a daily basis.

- There is no ability to assign an expense to a different entity, other than the entity the card is assigned to. When you have employees that travel to multiple sites, their expenses must manually be allocated on the back end.

- Automated Accounts Payable Processes

- 80%8.0

- Vendor Management

- 90%9.0

- Customizable Approval Policies

- 80%8.0

- Financial Document Management

- 80%8.0

- Payment Status Tracking

- 90%9.0

- Payment Audit Trail

- 90%9.0

- Duplicate Bill Detection

- 100%10.0

- Advanced OCR

- 70%7.0

- Electronic Funds Transfer

- 70%7.0

- The software saved us hundreds of thousands of dollars by flagging duplicate spend.

- By using the accounts payable management tool, we saved 10 hours per week on making manual payments.

- The GL integration feature saved us 10 hours per week that used to be spent recording bills/payments in NetSuite.

Airbase solves multiple AP pain points in one easy to use platform.

- Expense management.

- Reimbursement.

- Vendor payments.

- Amortization of prepaid expenses.

- Reporting of prepaid expenses.

- Check payments.

- Automated Accounts Payable Processes

- 80%8.0

- Vendor Management

- 100%10.0

- Customizable Approval Policies

- 80%8.0

- Financial Document Management

- 60%6.0

- Payment Status Tracking

- 90%9.0

- Payment Audit Trail

- 100%10.0

- Duplicate Bill Detection

- 100%10.0

- Advanced OCR

- 90%9.0

- Electronic Funds Transfer

- 100%10.0

- Reduced time to reimburse expenses by 28 days.

- Improved vendor visibility into payments.

- Allowed for real-time visibility into expenses.

- Vendor payments

- Reimbursement

- Virtual cards

- Physical cards

- Monthly home office internet reimbursements

- Travel expenses

- Purchase orders and requisitions

- Advanced approvals

- Cloud Solutions

- Scalability

- Integration with Other Systems

- Ease of Use

- Implemented in-house

- Resistance to change

- Department budget ownership

- Online Training

- Reimbursements

- Approval workflows

- Amortization reconciliation

- Bill approvals

- Quickbooks

- Slack

- Okta

- Netsuite

- Single Signon

- Expense reimbursement reports (not yet released)

- Better reconciliation reports

- Easier reimbursement tracking

Airbase is simple and easy to use

- Easy to use

- Clean UI

- Approval processes

- I wish it was easier to delete cards no longer in use

- Automated Accounts Payable Processes

- 50%5.0

- Vendor Management

- 50%5.0

- Customizable Approval Policies

- 100%10.0

- Financial Document Management

- 80%8.0

- Payment Status Tracking

- 80%8.0

- Payment Audit Trail

- 50%5.0

- Duplicate Bill Detection

- 50%5.0

- Advanced OCR

- 50%5.0

- Electronic Funds Transfer

- 50%5.0

- Positive ROI Impact by making payment much easier

Consolidate 3 spend workflows into 1 and improve them all.

- User interfaces are intuitive, and I consider myself a superuser in Airbase despite not having any training.

- Making requests for spend is very easy and also versatile.

- Approval workflows are better than competitors.

- While I give a lot of praise for the approval workflows, they could be even better for our use case.

- I have bulk-uploaded receipts from a full year of software use, and only a few were assigned to the right transaction, so it seems there is room for improvement in the receipt-scan-pair functionality.

- I would love to see a "date entered into Airbase" or "date opened for your approval" for bills. Sometimes, I get nagged about several old bills that I need to approve, and I have to do research to find out that I actually could not approve them until the day before or something like that.

- Automated Accounts Payable Processes

- 90%9.0

- Vendor Management

- 90%9.0

- Customizable Approval Policies

- 70%7.0

- Financial Document Management

- 70%7.0

- Payment Status Tracking

- 100%10.0

- Payment Audit Trail

- 100%10.0

- Duplicate Bill Detection

- 90%9.0

- Advanced OCR

- N/AN/A

- Electronic Funds Transfer

- 80%8.0

- The cashback makes Airbase pay for itself, so there's hardly any investment.

- Being able to cut from 3 vendors to 1 saves us a lot of time.

- Having more information in one vendor makes tracking expenses company-wide easier, saving time.

- No more letting software costs run because whoever can remove the company card with the vendor has quit. This is rare, but it has happened—no more.

- BILL and Expensify

Control Your Spend with Airbase

- We really like that virtual cards can be created for each specific vendor.

- It is super user-friendly and has been easy for our team to adopt; minimum to no training required!

- It would be nice to have a mobile app as nice as the web app.

- We would like to see Airbase evolve into a product that can help manage the entire purchase cycle, not just the purchase request.

- Airbase gives us better protection against fraud and erroneous charges.

- We can process and pay vendors quicker, which has improved our relationships with some of our best suppliers.